maine excise tax rates

Maine Watercraft Excise Tax Law - Title 36 Chapter. DYER LIBRARY SACO MUSEUM.

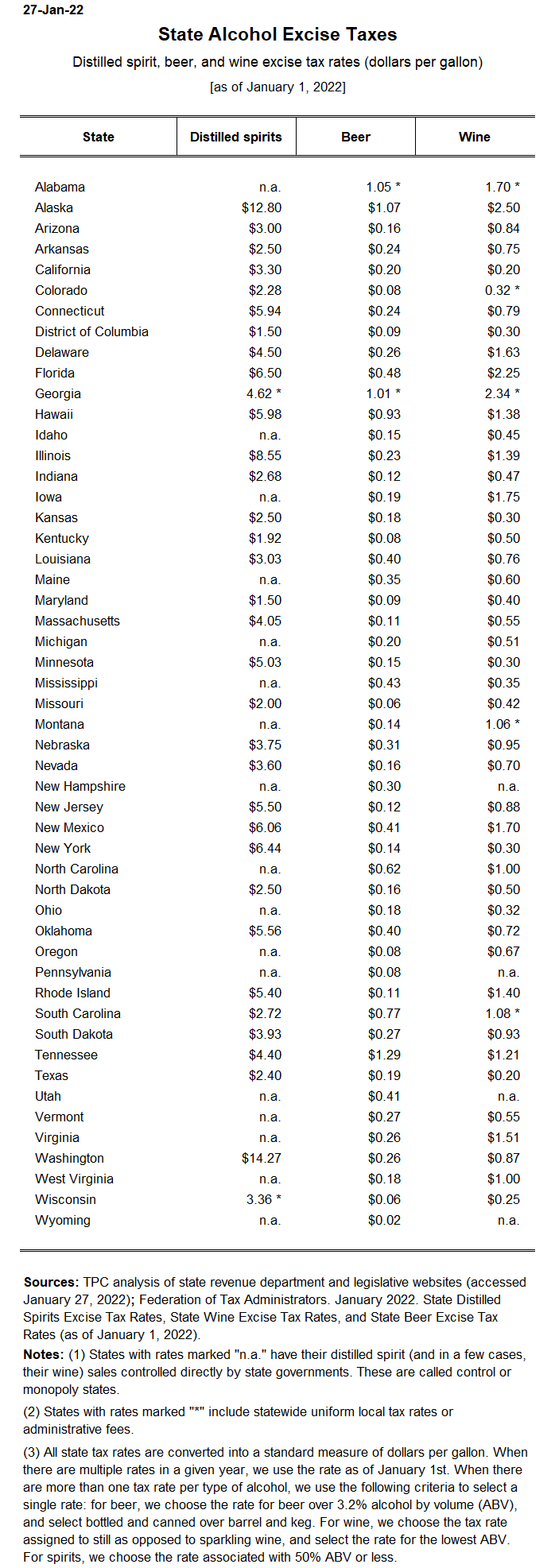

State Alcohol Excise Tax Rates Tax Policy Center

1 City Hall Plaza Ellsworth ME 04605.

. Share this Page How much will it cost to renew my registration. Federal excise tax rates on beer wine and liquor are as follows. Maine tax rates compared to other states.

The Maine State Statutes regarding excise tax can be found in Title 36 Section 1482. 16 rows Effective July 1 2009 the full diesel excise tax rate is imposed on biodiesel fuels that. Watercraft Excise Tax Payment Form - 2022.

These rates apply to the tax bills. YEAR 1 0240 mil rate YEAR 2. Watercraft Excise Tax Rate Table.

MAINE OFFICE OF TOURISM. Boat Launch Season Pass - Piscataqua River Boat Basin. Welcome to Maine FastFile.

The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55. Watercraft Excise Rate Chart. The study found eight.

Enter your vehicle cost. Visit the Maine Revenue Service page for updated mil rates. - NO COMMA For.

Owners of any watercraft located in Maine including documented watercraft must pay their annual excise tax. Exact tax amount may vary for different items. 1800 per 31-gallon barrel or 005 per 12-oz can.

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. 13 rows Maine Tax Portal. Mil rate is the rate used to calculate excise tax.

Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below. The price of all motor fuel sold in Maine also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to. Departments Treasury Motor Vehicles Excise Tax Calculator.

As of August 2014 mil rates are as follows. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. 2022 Watercraft Excise Tax Payment Form.

Title 36 1504 Excise tax. We administer the real estate transfer tax commercial forestry excise tax. The excise tax due will be 61080.

2721 - 2726. Maine Watercraft Excise Tax Law - Title 36 Chapter 112. Monday June 13 2022.

Designed to provide the public with answers to some of the. Monday-Friday 8AM to 5PM. In other words the registration rates of those counties exceeded 100 of eligible voters.

107 - 340 per gallon or 021 - 067 per 750ml bottle. Beginning April 1 1984 upon payment of the excise tax the municipality shall certify on forms provided by the Department of Inland Fisheries and Wildlife. The data sources for excise tax rates and bases on e-cigarettes in 28 states and DC were the Centers for Disease Control and Prevention and the Public Health Law Center9 10 We.

The rates drop back on January 1st each year. 2022 Maine state sales tax. WATERCRAFT EXCISE TAX RATES Commercial Tax 300 300 Tax 300 Tax 350 Tax 500 650 1000 Tax 550 700 1050 Tax 650 800 1150 Tax 750 900 1250 Tax 900 1050 1400 Tax.

To calculate your estimated registration. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. 18 rows Commercial Forestry Excise Tax.

6 year 0040 mil rate If a town did not collect excise tax then. Interest Rates 1992 to Present. Federal Fuel Excise Taxes.

Maine residents pay the tax to the town where they reside.

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

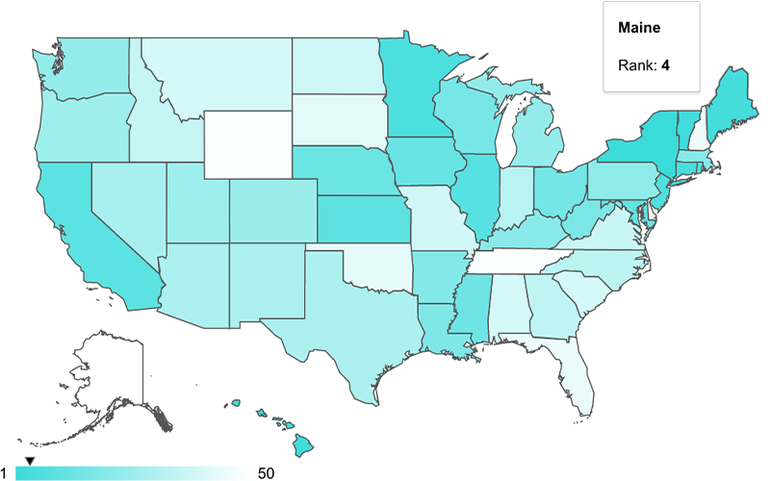

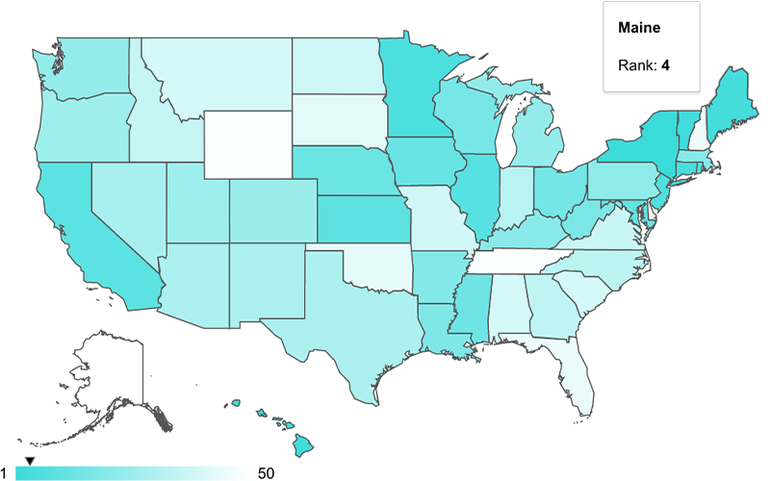

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Figure 10 State Cigarette Excise Tax Rates By Pack In 201 Flickr

Historical Maine Tax Policy Information Ballotpedia

Maine Car Registration A Helpful Illustrative Guide

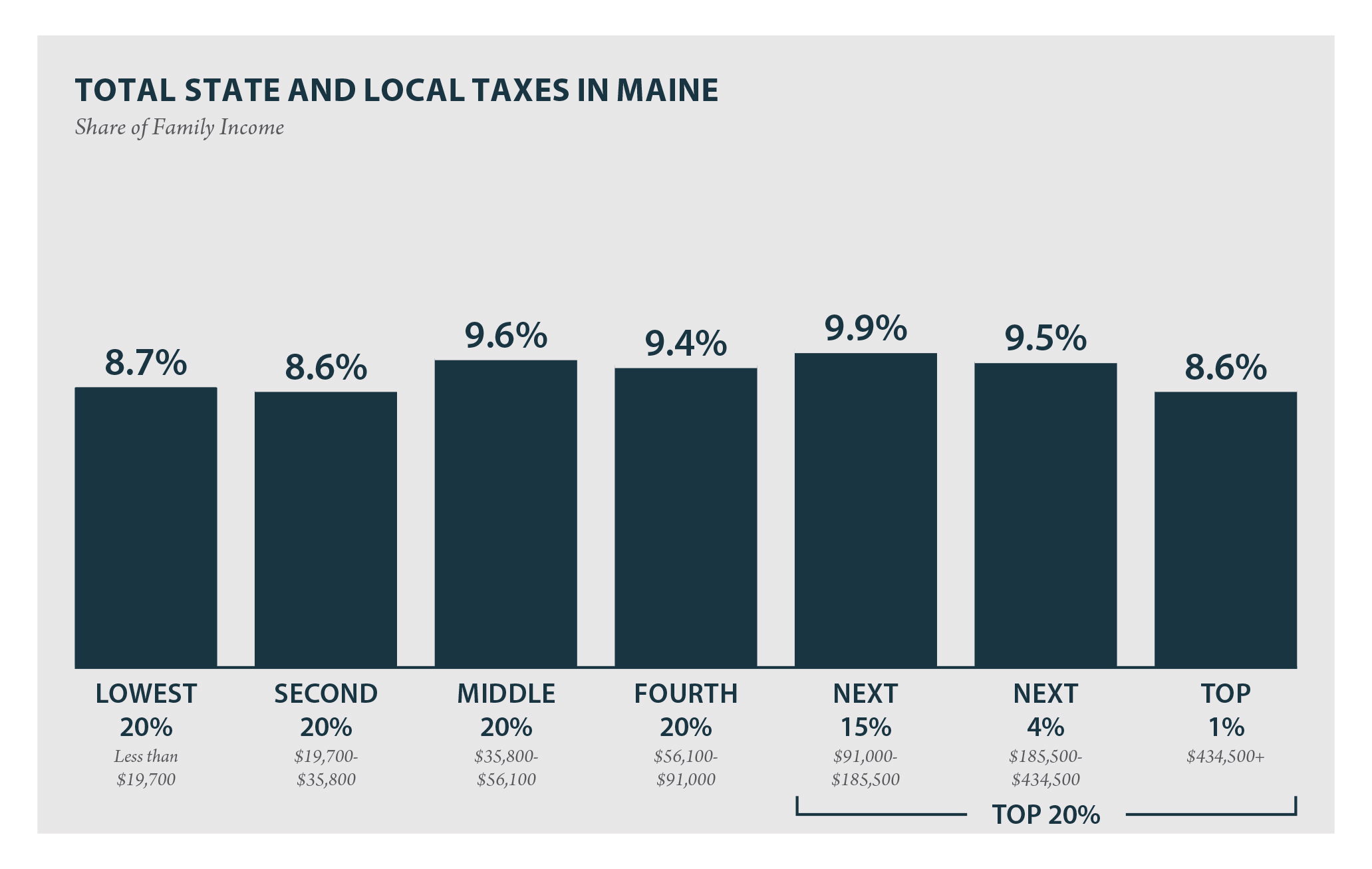

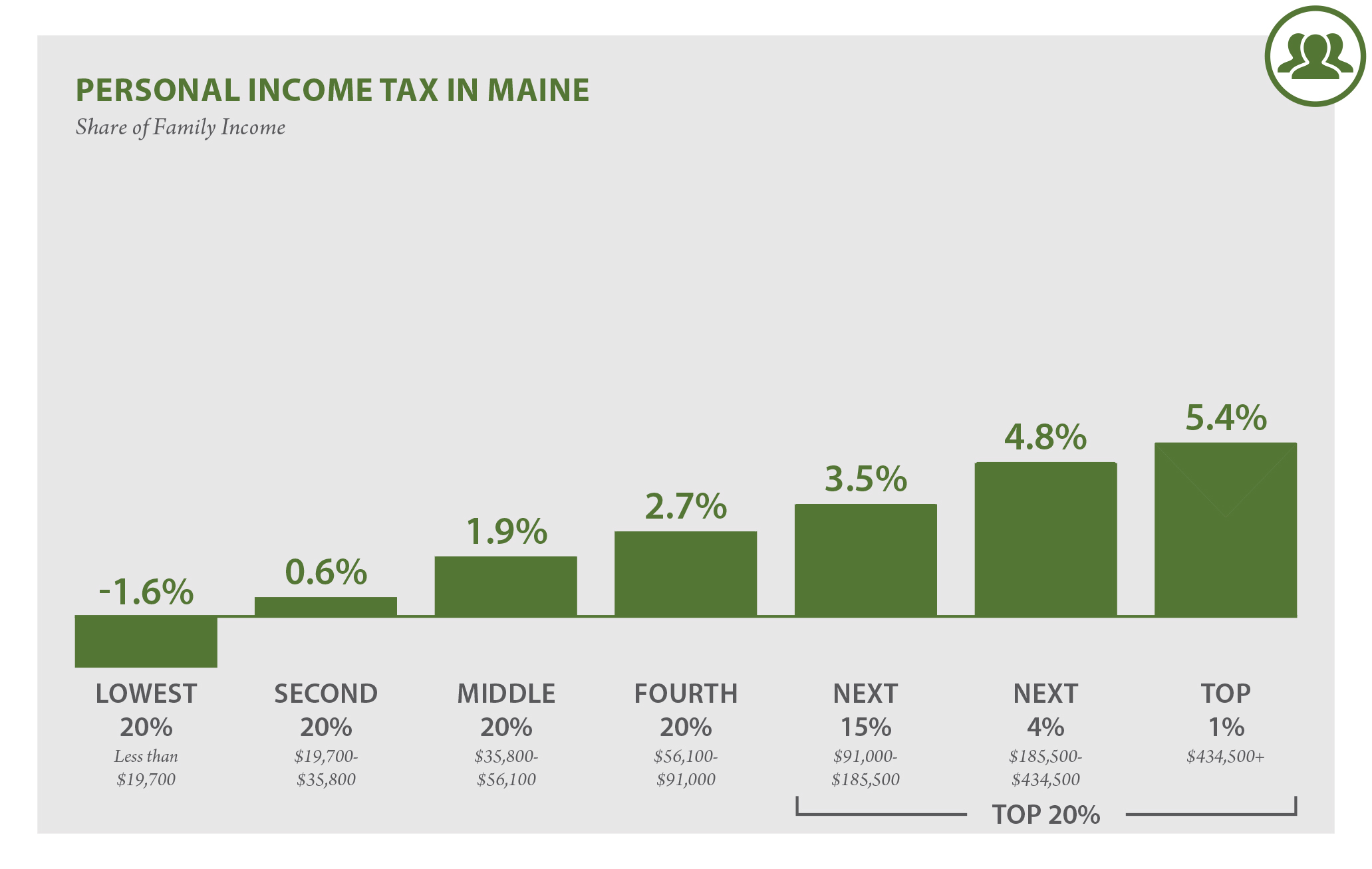

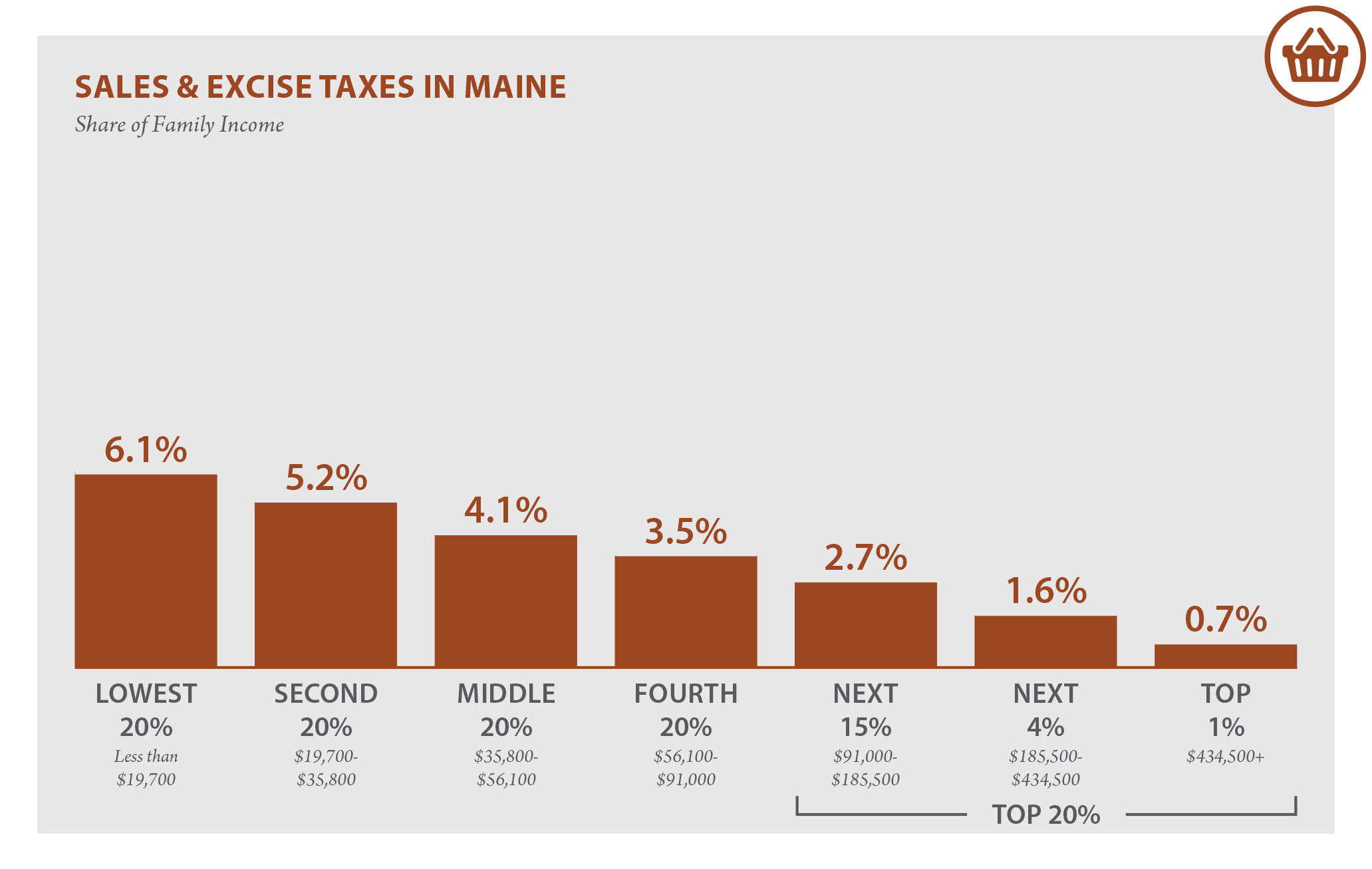

Maine Who Pays 6th Edition Itep

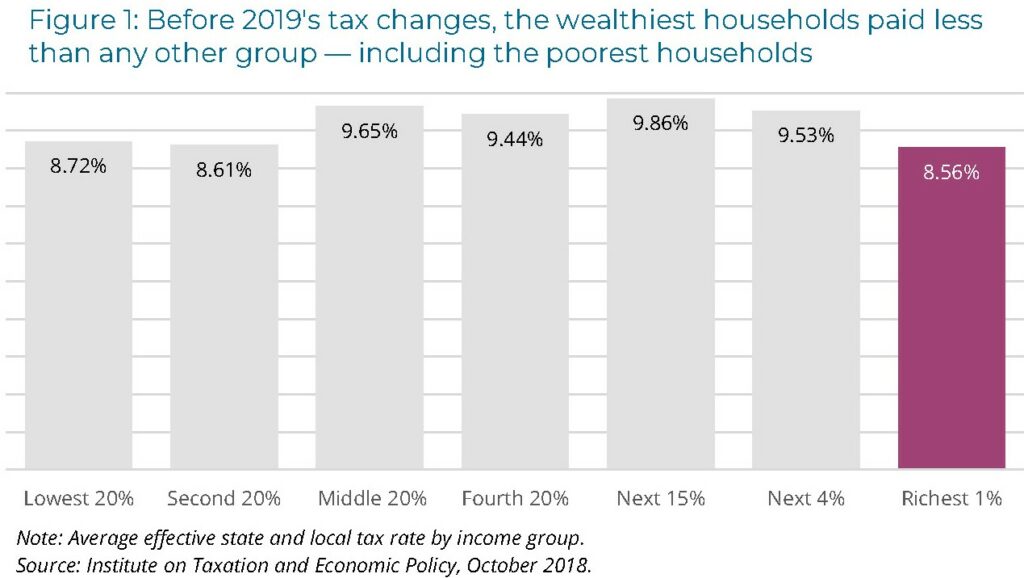

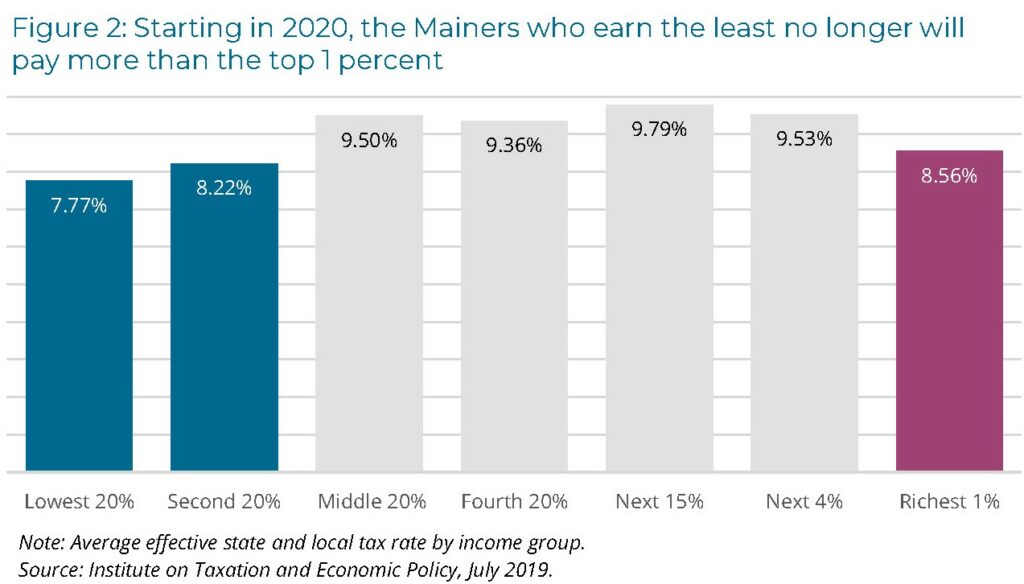

Maine Reaches Tax Fairness Milestone Itep

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Maine Reaches Tax Fairness Milestone Itep

Maine Who Pays 6th Edition Itep

Maine Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Maine S Governor Proposes To Replace The Income Tax With A Broader Sales Tax Tax Foundation

Excise Tax Information Cumberland Me

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute